CORPORATE AND ESG GOVERNANCE

Principle 1: Businesses should support and respect the protection of internationally recognized human rights.

Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining.

Principle 8: Businesses should undertake initiatives to promote greater environmental responsibility.

Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery.

Corporate Governance System

KMG’s corporate governance system is based on respect for the rights and legitimate interests of shareholders and key stakeholders, including the state, strategic partners, contractors, investors, employees, municipalities, local communities, and residents of the regions where the Company operates.

Corporate governance at KMG is continuously improving in line with Kazakhstani and international standards, as well as best practices. A key element of the system is the integration of sustainable development principles, which supports long-term value creation, effective risk management, and the consideration of environmental, social, and governance (ESG) factors in strategic and operational processes.

Corporate Governance Structure

KMG’s corporate governance system includes the following bodies:

- General Meeting of Shareholders – the supreme governing body that determines the strategic direction of the Company;

- Board of Directors – the governing body accountable to the General Meeting of Shareholders, providing overall oversight of the Company’s activities;

- Committees under the Board of Directors – specialized bodies that review and prepare decisions on key issues:

- Nomination and Remuneration Committee – responsible for HR policy, remuneration systems, and employee development;

- Strategy and Portfolio Management Committee – addresses strategic development, investment policy, and business transformation;

- Audit Committee – oversees financial reporting, internal controls, and risk management;

- HSE and Sustainable Development Committee – ensures the integration of sustainability principles and monitors environmental and social performance;

- Management Board – the executive body accountable to the Board of Directors, responsible for the Company’s day-to-day operations;

- Internal Audit Service – an independent control body reporting to the Board of Directors, evaluating the internal control system and risk management;

- Corporate Secretary – an independent officer responsible for implementing and monitoring corporate governance practices;

- Compliance Service – a body reporting to the Board of Directors, ensuring compliance with anti-corruption regulations and ethical business conduct;

- Ombudsperson – advises employees and facilitates resolution of labor and ethical issues.

Board of Directors Composition

As of December 31, 2024, the members of the Board of Directors of KMG are:

- Yernat Berdigulov Chairman of the Board of Directors, representative of Samruk-Kazyna JSC

- Askhat Khassenov Executive Director, Chairman of the Management Board of KMG

- Philip Malcolm Holland Independent Non-Executive Director

- Uzakbay Karabalin Non-Executive Director, representative of Samruk-Kazyna JSC

- Yelzhas Otynshiyev Representative of Samruk-Kazyna JSC

- Armanbai Zhubayev Independent Non-Executive Director

- Arman Argingazin Independent Non-Executive Director

- Saya Mynsharipova Independent Non-Executive Director

- Askar Shakirov Independent Non-Executive Director

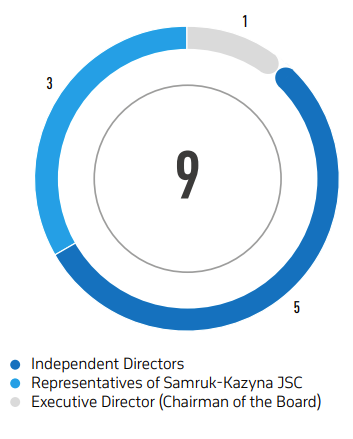

BOARD OF DIRECTORS STRUCTURE, NUMBER OF PERSONS

Independence

The Board of Directors complies with the requirements of the Corporate Governance Code regarding the number of independent directors, who make up more than 50 % of the total composition. All Committees of the Board are chaired by independent directors, and the Chairman of the Board is a representative of Samruk-Kazyna JSC.

Balance of Competencies

The Board maintains a balance of competencies, experience, and professional knowledge that supports objective and effective decision-making in the interests of KMG and in alignment with sustainable development principles.

Term of Office

The term of office for the Board of Directors is three years. Reappointment for a period longer than six consecutive years requires special consideration. An independent director may not serve on the Board of Directors for more than nine consecutive years. Appointment for a term of up to nine years is permitted only in exceptional cases.

Nomination and Selection of Board Members

The nomination and selection process is governed by KMG’s Charter and regulatory documents, ensuring transparency, fairness, and professionalism.

Candidates are selected by the General Meeting of Shareholders together with the Board Chair and Chair of the Nomination and Remuneration Committee. They must possess the necessary knowledge, skills, and experience, contribute to the long-term development of the Company, and have an impeccable business reputation.

According to KMG’s Board Succession Policy, appointments and succession plans must be merit-based and promote gender, social, and ethnic diversity, as well as cognitive and personal strengths.

The Chair and members of the Board are elected by the General Meeting of Shareholders. Independent directors are appointed in accordance with the Rules for the Formation of Boards of Directors approved by Samruk-Kazyna JSC.

According to corporate standards and legislation, the Chair of the Management Board may not serve as Chair of the Board of Directors.

Board Skills Development

Board members regularly improve their professional skills, including management of economic, environmental, and social aspects. The Nomination and Remuneration Committee analyzes the balance of competencies to ensure alignment with the Company’s strategic goals. Training information is published on KMG’s website.

The Health, Safety, Environment and Sustainable Development Committee's Performance in 2024

In 2024, the Health, Safety, Environment and Sustainable Development Committee held 10 meetings and reviewed 55 issues related to integrating sustainability into KMG’s business processes.

Key activities included:

- Guiding sustainability integration into KMG’s core processes;

- Overseeing ESG strategies and initiatives;

- Monitoring occupational health, industrial safety, and environmental protection;

- Developing and approving internal documentation and action plans on sustainability.

Committee's Key agenda items in 2024:

- Reports on labor protection, safety, and environment;

- Implementation of KMG’s Low-Carbon Development Program (2022–2031);

- ESG rating assessment and improvement plans;

- Introducing sustainability systems across business units;

- Contribution to UN Sustainable Development Goals;

- Approval of KMG’s Low-Carbon Development Program to 2060;

- Analysis of significant health, safety, and industrial risk incidents.

The Committee reviewed and approved KMG’s 2023 Sustainability Report.

Executives and employees of KMG regularly participated in the Committee’s work, and the Board of Directors adopted the Committee’s recommendations.

Evaluation of the Board of Directors' Performance

The Board, its committees, and members undergo annual evaluations per KMG’s Corporate Governance Code. Every three years, an external consultant is engaged.

In 2024, a self-assessment was conducted for 2023, covering composition, processes, and behavior. Results were reviewed by the Board, identifying areas for improvement, such as diversity and succession. An action plan was developed.

In December 2024, the Board decided to conduct an external evaluation in 2025 covering the Board, its committees, the Chair, members, and the Corporate Secretary. The evaluation will form part of the corporate governance diagnosis and internal audit system effectiveness review. A technical specification was prepared in Q1 2025 and reviewed by relevant committees and the Board.

Remuneration

Board Remuneration

The remuneration of the members of the Board of Directors of KMG is determined by the decision of the General Shareholders’ Meeting and is paid to independent directors and representatives of “Samruk-Kazyna” JSC. It is fixed and determined based on the Company’s scale, responsibilities, and strategic goals.

The approach to remuneration is aligned with the Rules for the Formation of Boards of Directors/Supervisory Boards of “Samruk-Kazyna” JSC companies and aims to attract and retain qualified professionals. In 2024, KMG did not engage external consultants to determine remuneration.

The Nomination and Remuneration Committee reviews remuneration matters as needed, including during Board performance evaluations.

Management Board Remuneration

The Board of Directors sets remuneration policy and performance evaluation procedures for Management Board members in accordance with the Corporate HR Management Standard of Samruk-Kazyna JSC.

Annual remuneration is paid based on performance evaluations to motivate achievement of strategic and priority goals, expressed through measurable and interconnected KPI maps. These include corporate and functional KPIs.

A Nomination and Remuneration Committee under the Board reviews remuneration matters to ensure an effective and transparent system.

Management Board Composition

As of the end of 2024, the members of KMG’s Management Board were:

|

A.G. Khassenov |

Chairman of the Management Board |

|

K.O. Iskaziyev |

First Deputy Chairman of the Management Board |

|

S.A. Brekeshev |

Deputy Chairman of the Management Board (Gas Projects and Low-Carbon Development) |

|

B.K. Abaiyldanov |

Deputy Chairman of the Management Board (Exploration and Production) |

|

R.A. Balykbayev |

Deputy Chairman of the Management Board (Major Oil and Gas Projects) |

|

A.M. Magauov |

Deputy Chairman of the Management Board (Oil Refining and Petrochemicals) |

|

B.K. Zakirov |

Deputy Chairman of the Management Board (Oil Transportation and International Projects) |

|

D.E. Abdulgafarov |

Deputy Chairman of the Management Board (Strategy, Investments and Business Development) |

|

D.A. Aryssova |

Deputy Chairman of the Management Board (Economy and Finance) |

|

V.S. Lavrenov |

Deputy Chairman of the Management Board (Legal Affairs and Corporate Security) |

Notification of the Board of Directors on Critical Issues

The Board of Directors of KMG receives regular reports on the Company’s activities, covering key strategic, financial, and operational aspects, as well as updates on critical matters. These include:

- Report from the Chairman of the Management Board – on major changes and the overall performance of the Company;

- Financial and operational reports – on preliminary results, investment projects, and strategy implementation;

- Reports on occupational safety and environmental protection – including information on significant incidents and preventive measures;

- Risk and corporate governance reports – tracking implementation of Board decisions, committee reports, and corporate transaction analyses.

In the event of urgent issues, including financial indicators, critical incidents, or operational matters, the Board of Directors is notified immediately.

Conflict of Interest

Conflict of interest management at KMG is regulated by the Conflict of Interest Policy and the Code of Business Ethics, both approved by the Board of Directors.

Every employee and officer is responsible for complying with the requirements of this policy. Upon hiring, appointment, or transfer to a new position, mandatory disclosure of potential conflicts of interest is required, including:

- Ownership of shares in KMG counterparties or competitors;

- Participation in governing bodies of counterparties or competitors;

- Interactions with KMG counterparties;

- Intent to acquire KMG assets or securities.

The verification process includes an analysis of potential affiliated relationships and ensures compliance with anti-corruption legislation.

Stakeholder Engagement

KMG’s highest corporate governance bodies maintain ongoing dialogue with stakeholders on economic, environmental, and social matters.

Consultations are conducted through various channels, including the official website, the Press Office, and the annual Sustainability Report, which serves as a key tool for disclosure and engagement with both internal and external stakeholders.

Additionally, KMG uses specialized platforms for targeted interaction:

- For investors – a portal with up-to-date information;

- For employment inquiries – a job vacancies portal;

- For reporting labor rights violations – hotline: nysana@cscc.kz;

- Confidential reporting system – online portal;

- Functional contact areas:

- Ombudsperson: ombudsman@kmg.kz;

- Occupational health and environment: hse@kmg.kz;

- Sustainable development: sustainability@kmg.kz.

These mechanisms ensure transparency, information accessibility, and effective stakeholder engagement.

Compliance with Legislation

Anti-Competitive Behavior

During the reporting period, 4 administrative cases were initiated against KMG and its Group companies for violations of antimonopoly legislation (1 case involving KMG and 3 involving subsidiaries). Three of these cases were resolved unfavorably for KMG and its subsidiaries by the courts, while one was settled through mediation.

Additionally, two civil cases related to antimonopoly laws were reviewed by the courts (one ruled in favor of the subsidiary; in the other, the claim was withdrawn by the subsidiary).

Socio-Economic Compliance

No civil or administrative cases were recorded concerning violations or disputes related to legal or regulatory acts in the field of social and economic regulation, or disputes with local communities.

However, 29 labor-related lawsuits were filed with the courts, in which subsidiaries were defendants in 24 cases and plaintiffs in 5 cases.

Anti-Corruption

GRI 2-15GRI 3-3GRI 205-1GRI 205-2GRI 205-3

KMG conducts its operations based on the principles of legality, integrity, and ethical conduct. The Company strictly adheres to human rights standards, takes all necessary measures to prevent corruption, and strives to maintain an impeccable reputation by integrating international ethical standards into its business processes.

The Compliance Service, an independent division within the Company, is responsible for minimizing corruption risks in the workplace. This service is fully integrated into the operations of all business units at KMG.

In 2024, a number of internal documents were updated, including the Anti-Corruption Policy and the Regulations on Handling Reports of Violations related to the laws of the Republic of Kazakhstan and KMG’s internal regulations on anti-corruption activities. These updates are aimed at aligning the Company’s practices with high standards of ethical business conduct.

The Compliance Service also monitors the use of insider information and conducts due diligence checks on the Company’s counterparties. This helps minimize the risk of entering into agreements with unreliable partners, thereby reducing the likelihood of non-delivery of goods, failure to perform work, or failure to provide services.

Candidate screenings are conducted for positions involving administrative or managerial responsibilities. These include mandatory psychological assessments and polygraph tests, especially for roles involving procurement activities.

One of the key areas of focus is the internal analysis of corruption risks, which helps identify factors contributing to corruption and weaknesses in business processes. In 2024, such assessments were conducted in 35 subsidiaries and dependent entities, as well as within the Company’s Central Office. Based on the results, recommendations and action plans were developed to address the findings.

During the reporting period, six confirmed cases of corruption were recorded. All six cases resulted in the dismissal or punishment of employees for corrupt actions. Nevertheless, KMG continues to strengthen its anti-corruption culture, including engaging top management in awareness-raising initiatives for employees and counterparties to emphasize the unacceptability of corrupt practices. In 2024, the number of employees who underwent anti-corruption training was 5,753.

Tax Policy and Payments to the State

Approach to Taxation

NC KazMunayGas JSC has adopted a Corporate Tax Accounting Policy (Corporate TAP) aimed at standardizing tax accounting practices across the KMG Group organizations. The document is based on the tax legislation of the Republic of Kazakhstan (RoK), International Financial Reporting Standards (IFRS), and KMG’s internal regulations.

The Corporate TAP is guided by the following principles:

- Obligation to Pay Taxes – KMG and its subsidiaries pay taxes to the RoK budget fully and on time;

- Fairness of Taxation – double taxation of the same object within the same period is not allowed;

- Good Faith – obtaining benefits through illegal actions aimed at tax avoidance is not acceptable.

KMG’s approach to taxation takes into account the specifics of the Group’s commercial activities and their social impact. The tax policy is fully aligned with the KMG Development Strategy for 2022–2031.

The Corporate TAP is followed by all subsidiaries, except for:

- Entities engaged in subsoil use operations under production sharing agreements that provide for a special stable tax regime;

- Entities registered outside of Kazakhstan, including branches of KMG and its subsidiaries incorporated outside of Kazakhstan.

Based on Corporate TAP, KMG and all its subsidiaries have developed and implemented individual Tax Accounting Policies that consider the specific characteristics of their industry operations.

Information on tax payments to governments is published annually on KMG’s corporate website: https://www.kmg.kz/en/investors/reporting/.

Tax Administration and Control

KMG’s tax risk management approach is integrated into its Corporate Risk Management System (CRMS). As part of its monitoring activities, KMG analyzes the application of tax legislation and proposes improvements where needed.

Stakeholder Engagement

KMG is included in the list of large taxpayers subject to tax monitoring. In its interaction with government authorities, the Company:

- Initiates amendments to tax legislation to foster a favorable tax environment for KMG operations;

- Engages in dialogue with shareholders, industry associations, and government agencies. Reviews and provides opinions on draft regulatory legal acts;

- Advocates for the interests of the KMG Group by supporting improvements in tax and customs legislation.

KMG’s tax policy is aimed at ensuring transparency in tax administration, compliance with national legislation, and effective collaboration with regulatory authorities to enhance the overall tax environment.

Tax Payment Indicators, KZT billion

|

Indicator |

2022 |

2023 |

2024 |

|---|---|---|---|

|

Tax payments to the RoK budget |

1,037.2 |

1,039.2 |

1,079.7 |

|

RoK share under PSAs (Production Sharing Agreements) |

138.7 |

123.3 |

129.2 |

|

Total |

1,175.9 |

1,162.5 |

1,208.9 |