ESG Risk Management

The risk management system at NC KazMunayGas JSC is a key component of corporate governance, aimed at the timely identification, assessment, and mitigation of potential events that may affect the achievement of the Company’s strategic and operational objectives. Risk management is carried out at all organizational levels, covering both the parent company and its subsidiaries and affiliates.

KMG adheres to recognized international risk management standards, particularly the “Three Lines of Defense” model embedded in the corporate risk management framework. This model ensures a clear distribution of roles and responsibilities among operational units, risk management functions, and internal audit, creating a reliable system of control and risk prevention.

Sustainable development is one of KMG’s strategic goals, as outlined in the Company’s Development Strategy through 2031. ESG risk management is fully integrated into the overall risk management system and serves as a tool to enhance the Company’s adaptability to external changes, minimize potential negative impacts, and ensure long-term growth aligned with stakeholder interests.

In 2024, KMG updated its consolidated Risk Register, incorporating factors that influence the sustainable development of the Group. The effective use of risk information in managerial decision-making helps reduce uncertainty, build a resilient operating model, and ensure business stability in the face of dynamic economic, environmental, and social challenges.

ESG Risks

|

Trend (over the year) |

Risk Description |

Mitigation Measures |

|---|---|---|

|

Environmental Aspect |

||

|

Climate risks and low-carbon development |

||

|

|

Climate risks for KMG are associated with the transition to a low-carbon economy and the physical impacts of climate change. These include: Transition risks – tightening regulatory requirements, changes in technology, market risks, and reputational risks; Physical climate risks – extreme weather events (floods, droughts) and chronic climate changes (water stress, rising temperatures). In 2024, floods in KMG’s regions of operation, including Atyrau, Aktobe, and West Kazakhstan regions, led to a state of emergency, requiring urgent measures to minimize damage. Potential Impact Climate risks may lead to increased costs, reduced profitability, limited market opportunities, deterioration of employee health, and a higher likelihood of injuries. They may also impact demand for the Company’s products and the long-term sustainability of the business. |

KMG is actively working to reduce climate risks, including:

KMG continues to improve its climate adaptation measures, reducing the impact of climate risks on the Company’s operations. |

|

Risk of Negative Environmental Impact |

||

|

|

KMG is exposed to the risk of negative environmental impact, including emissions of pollutants into the air, water and soil contamination, as well as increasing environmental regulatory requirements. Non-compliance with environmental standards may lead to stricter sanctions, additional financial costs, and damage to the Company’s reputation. Potential Impact The realization of environmental risk may lead to fines, excess payments, environmental remediation costs, and legal liability. Furthermore, a decline in environmental performance may negatively impact investment attractiveness and the long-term sustainability of the business. |

To minimize environmental impact, KMG implements a comprehensive set of actions:

KMG continues to improve environmental protection measures, ensuring compliance with environmental requirements and reducing the impact of its operations on the environment. |

|

Risk of Oil Spills During Offshore Operations |

||

|

|

Oil spills may occur due to violations of technological procedures, pipeline accidents, equipment failures, and challenging natural conditions in the Caspian Sea. Risk factors include shallow waters, high reservoir pressure at fields, the presence of hydrogen sulfide, and seasonal surface freezing. Potential Impact Oil spills can cause severe environmental damage, halt production processes, and result in significant financial costs for response and compensation efforts. |

To minimize the risk of oil spills, KMG implements a range of preventive measures:

KMG continues to improve its oil spill prevention and response system, reducing potential environmental and financial risks. |

|

Risk of Industrial Accidents and Technogenic Disasters at Production Facilities |

||

|

|

KMG’s production activities involve a high level of hazard, creating the risk of accidents, explosions, fires, and other industrial disasters. Potential causes include equipment wear and tear, violations of technological processes, human error, and adverse external factors. Potential Impact Accidents at production facilities may result in injuries or fatalities, destruction of equipment and infrastructure, significant financial recovery costs, and environmental damage. |

To prevent accidents, KMG implements a comprehensive set of measures:

KMG continues to improve its systems for preventing and responding to technogenic risks, ensuring robust protection of personnel, equipment, and the environment. |

|

Social Aspect |

||

|

Occupational Injury Risk |

||

|

|

The risk of occupational injuries is associated with non-compliance with occupational safety rules, violations of workplace discipline, and exposure to hazardous and harmful production factors. This may lead to accidents, loss of working capacity, and threats to employee life. Potential Impact

|

To prevent workplace injuries, KMG implements a systematic approach to occupational health and safety:

KMG is committed to reducing injury rates by ensuring safe working conditions and fostering a strong safety culture among employees. |

|

Risk of Occupational Diseases and Threat of Emerging Strains and Viruses |

||

|

|

KMG’s production activities involve exposure to adverse factors such as intoxication, pollution, vibration, noise, and significant physical strain. Prolonged exposure to these factors can lead to occupational diseases. There is also a threat of infectious disease outbreaks, including new virus strains, which may impact employee health and the stability of production processes. Potential Impact

|

To reduce this risk, KMG implements the following measures:

KMG continues to enhance its occupational health and safety system, minimizing the risks of occupational diseases and infectious threats. |

|

Shortage of Qualified Personnel |

||

|

|

This risk is associated with employee turnover, a shortage of specialists with the required competencies, and potential challenges in attracting and retaining qualified personnel. The shortage may be driven by a competitive labor market, workforce migration, and evolving professional requirements. Potential Impact Decreased efficiency and productivity of the Company; Increased workload on existing staff, risking process disruptions; Delays in the implementation of strategic projects; Higher costs for recruitment, training, and onboarding of new employees. |

KMG implements a comprehensive approach to attract, develop, and retain talent:

KMG is actively addressing personnel risks by creating attractive conditions for employee growth and development. |

|

Terrorism Risk |

||

|

|

This risk is associated with the possibility of terrorist and other violent acts targeting the Company’s personnel, contractors, and assets. KMG operates in regions where there may be security threats, necessitating measures to protect employees and facilities. Potential Impact Threats to the life and health of employees; Disruption of operations and damage to Company assets; Increased costs for security and infrastructure restoration; Reputational and legal risks. |

KMG implements a comprehensive set of safety measures:

KMG continues to enhance its employee and facility protection measures, reducing terrorism-related risks. |

|

Social Climate in Regions of Operation |

||

|

|

This risk is associated with the potential for social tensions, unauthorized strikes, and protest actions in regions where KMG operates. The main causes include employee demands for higher wages, improved social conditions, and stronger labor guarantees. In 2024, 17 strikes were recorded in the Mangystau region, 11 of which involved KMG’s contractors. Despite the Company’s full compliance with its obligations to employees, social discontent remains a risk factor. Potential Impact Reputational risks and reduced public trust in the Company; Potential disruptions to operations; Increased operating costs related to resolving labor disputes; Impact on the Company’s investment attractiveness. |

KMG is taking a comprehensive approach to stabilize the social climate:

KMG continues to engage with employees and stakeholders to ensure social stability in the regions of operation. |

|

Corporate Governance |

||

|

Compliance Risks |

||

|

|

Compliance risks are associated with potential instances of corruption, violations of legislation, and internal regulatory documents, which may result in financial losses, reputational damage, and legal consequences. Ensuring transparency in business processes and adherence to ethical standards is a key priority for KMG. Potential Impact Financial losses and fines; Erosion of trust from investors and partners; Legal liability for the Company and its employees; Reputational risks affecting the sustainable development of the business. |

KMG implements a range of measures to prevent compliance risks:

KMG continues to improve its compliance control system, ensuring transparency of business processes and minimizing the risk of legal violations. |

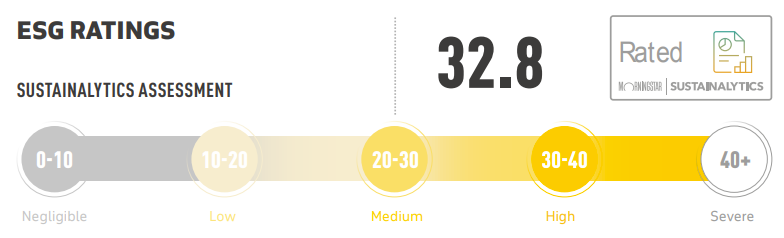

In November 2024, the international rating agency Sustainalytics assigned an ESG Risk Rating of 32.8 to NC KazMunayGas JSC. The Company ranked 49th out of 300 organizations assessed in the oil and gas sector.

The agency rated KMG’s ESG risk management at 67.3 points (“strong”), maintaining a stable level compared to 2023 (67.2). The Company’s exposure to ESG risks was assessed at 77 (“high”), slightly increasing from 2023 (74.0) due to methodological changes.

The Company achieved progress in several key areas. Notably, improvements in water resource management had a positive impact on the rating, confirmed by more detailed data disclosure, including water intensity indicators and new water efficiency initiatives. Significant progress was also made in corporate governance – an expanded list of assessment indicators enabled the Company to demonstrate transparency and a high level of governance practices. The development of low-carbon products and services, particularly through enhanced greenhouse gas disclosures in the CDP questionnaire, also contributed significantly to strengthening the Company’s standing.

At the same time, there is room for further improvement, particularly in community engagement, disclosure of lobbying activities, and more detailed reporting on payments to government bodies. Additionally, methodological changes impacted the emissions and waste category, leading to a lower score due to the addition of new indicators reflecting stricter expectations for emissions intensity.

Detailed information on the Sustainalytics rating is available at the following link. https://www.sustainalytics.com/esg-rating/national%20company-kazmunaygas-jsc/1028382256

International Rating Agency Sustainalytics (Amsterdam, Netherlands)

Sustainalytics is a globally recognized independent provider of environmental, social, and governance (ESG) research, ratings, and analytics, that helps investors around the world develop and implement responsible investment strategies.

Sustainalytics Assessment Methodology

The ESG Risk Rating is based on an analysis of a company’s exposure to material ESG risks and its effectiveness in managing those risks. The rating is on a scale from 0 to 100, with “0” indicating negligible risk. In 2024, the methodology was updated, resulting in a redistribution of indicator weights and the addition of new parameters.

MSCI Rating

According to MSCI, NC KazMunayGas JSC maintained its ESG rating of “BBB” in 2024, which corresponds to an average level within the industry. This reflects balanced management of environmental, social, and governance risks.

The Company shows steady progress in managing carbon emissions, biodiversity, and land resources. Notably, carbon management scores improved by 1.2 points due to lower operational and regulatory risks in this area compared to peers. The Company’s efforts to prevent adverse ecosystem impacts, land reclamation initiatives, and the use of oil waste recycling technologies were viewed positively.

KMG’s Low-Carbon Development Program (2022–2031), which targets a 15 % reduction in Scope 1 and Scope 2 emissions by 2031 (from a 2019 baseline), also received a favorable evaluation.

In terms of social responsibility, KMG performs at an average level globally, due to the sectoral impact of operations on local ecosystems and communities. However, its strong certification in employee health and safety systems aligns with industry standards.

International Rating Agency MSCI (New York, USA)

MSCI Inc. is an American financial services company that provides global equity, bond, and real estate indexes, ESG and climate products, and portfolio analytics. It helps investors worldwide make informed decisions by offering data and tools to evaluate risks and opportunities across asset classes.

MSCI Assessment Methodology

MSCI’s ESG rating is a sector-relative measure of a company’s management of financially relevant ESG risks and opportunities. It is assessed on a seven-point scale from AAA (highest) to CCC (lowest), based on the company’s exposure to and management of ESG factors.

For reference

An ESG rating (Environmental, Social, and Governance) is an assessment of a company’s exposure to environmental, social, and governance risks and how effectively these are being managed. ESG ratings serve as a strategic tool for investors in making informed investment decisions and help identify both risks and opportunities, offering insight into

a company’s long-term sustainability and resilience.