Joint Stock Company “National Company “KazMunayGas” is a unique, vertically integrated oil and gas operator which implements the full production cycle, from exploration and production of hydrocarbons to special services.

KMG was established under a Decree of the President of the Republic of Kazakhstan (RoK) dated 20 February 2000 No. 811 – On the Measures to Ensure Future Interests of the State in Oil and Gas Sector of the Country Economy, and Resolution of the RoK Government dated 25 February 2002 – On the Measures to Implement Decree of the RoK President dated 20 February 2002 No.811. KMG is a successor of closed joint stock companies “National Oil and Gas Company “Kazakhoil””, “National Company “Oil and Gas Transport””, and Joint Stock Company “KazMunayGas – Processing and Marketing”. KMG was founded by the RoK Government represented by the State Property and Privatisation Committee under the RoK Ministry of Finance.

KMG shareholders are:

Joint Stock Company Sovereign Wealth Fund Samruk–Kazyna (JSC Samruk–Kazyna)

Republican State Institution National Bank of Kazakhstan

The KMG Group includes 135 companies with fifty or more percent of voting stocks/participation directly or indirectly owned by KMG, of which 68 assets are based in RoK. Other assets are based in such counties as Romania, Georgia, Switzerland, the Netherlands, Canada, Bulgaria, Ukraine, Moldova, Russia and Turkey.

On December 30, 2015, Resolution of the RoK Government approved the 2016–2020 Comprehensive Privatisation Plan, which included 73 companies of the KMG Group. Legal entities from the KMG Group are cut as a part of privatisation and divestment programmes.

November 5, 2020, Resolution of the KMG Board of Directors (Minutes No.13/2020) revised the Activity Plan to switch to the target asset structure of JSC NC “KazMunayGas” dated June 6, 2019.

The assets structure of the KMG Group is also being simplified by dissolving/reorganising subholdings. In 2020, the voluntary dissolution of KazMunayGas Exploration Production JSC continued, as a result, in 2019–2020, KMG purchased 8 companies from KazMunayGas Exploration Production JSC.

In 2020, KMG sold 3 companies, dissolved 2 companies and reorganized 1 company.

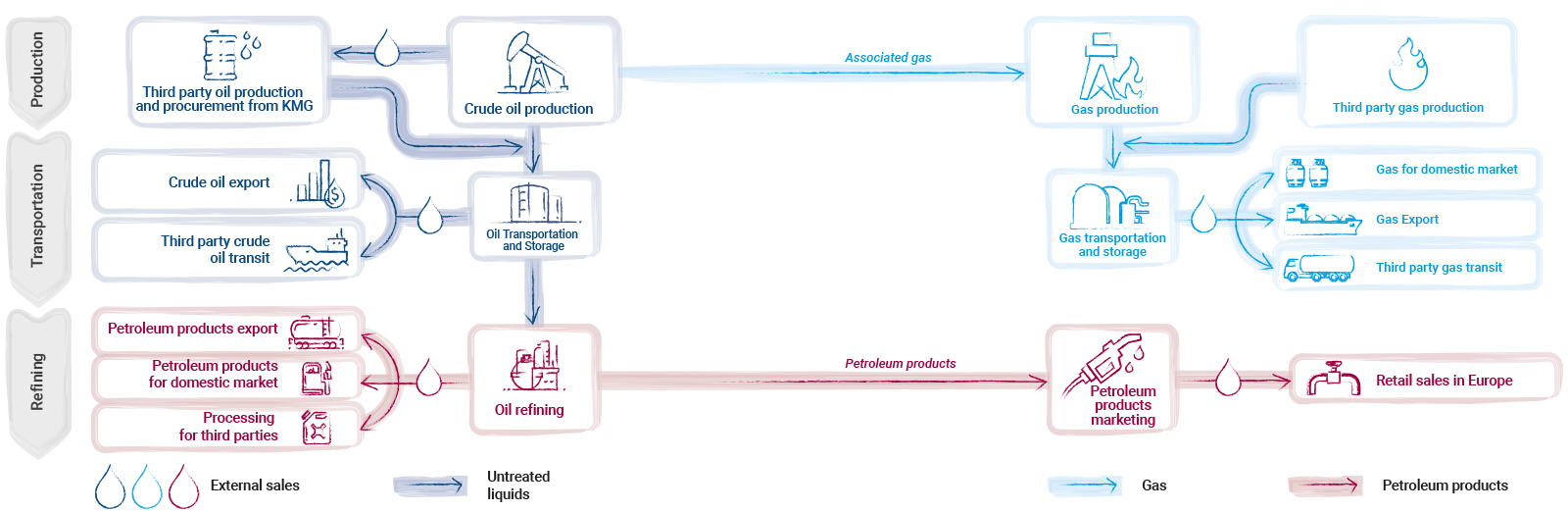

Production Value Chain

KMG ships diesel fuel for field agricultural work and supplies fuel oil to social production facilities and institutions during the heated season.

Also in 2020, KMG sold jet fuel to 2 local airports and 6 airline companies through KMG-Aero LLP.

- Sary-Arka Airport JSC

- Nursultan Nazarbayev International Airport JSC

- Deutsche Lufthansa Aktiengesellschaft (Germany)

- Aerofuels Overseas Limited (Russia)

- Air Astana JSC

- JSC QAZAQ AIR

- JSC Scat

- KazAviaSpas JSC

The remaining oil products are sold to third party consumers in the domestic market or exported.

In 2020, KMG exported petrol (163,000 t), and for the first time started to export diesel (115,000 t). Export of light petroleum products grew by 241,000 tonnes against 2019 as a result of lower consumption in the domestic RoK market.

Shipment of dark petroleum products to Europe, petrol supplies to European countries, Afghanistan, Georgia and Tajikistan were prevailing in the structure of export supplies in 2020. Diesel, petrochemistry, coke, sulphur and butane were supplied to Europe, China, Russia, Uzbekistan and Tajikistan.

JET A1 jet fuel production

Since 2020, all RoK oil refineries have had process capacities to produce international jet fuel class JET A1.

This is done to

- Ensure that aircrafts of domestic airline companies are ready to use JET A-1;

- Be able to make supplies to international market;

- Make RoK airports more attractive;

- Be able to develop fuel filling complexes of RoK airports according to international standards.

One of the main advantages of JET A-1 over TC-1 and RT fuels is the improved fire and explosion safety properties of JET A-1.

In 2020, KMG procured oil from 4 subsidiary oil producers in the West Kazakhstan for further processing at 2 oil refineries (Atyrau Refinery in the west and Pavlodar Refinery in the east).

The total cost of oil and processing services amounted to 302.2 bln tenge.

The country’s domestic market is 100 % filled with domestic oil.

WHOLESALE SALES OF KMG PETROLEUM PRODUCTS PRODUCED IN THE REPUBLIC OF KAZAKHSTAN, THOUSAND TONNES

|

Product |

2018 |

2019 |

2020 |

||||||

|

domestic market |

export |

total |

domestic market |

export |

total |

domestic market |

export |

total |

|

|

Gasoline |

701 |

0 |

701 |

789 |

37 |

826 |

647 |

163 |

810 |

|

Diesel |

954 |

0 |

954 |

1,028 |

0 |

1,028 |

930 |

115 |

1,045 |

|

Jet fuel |

34 |

0 |

34 |

85 |

0 |

85 |

65 |

0 |

65 |

|

Fuel oil |

192 |

414 |

606 |

188 |

469 |

657 |

211 |

402 |

613 |

|

Vacuum gas oil |

0 |

200 |

200 |

0 |

167 |

167 |

0 |

155 |

155 |

|

Bitumen |

53 |

0 |

53 |

65 |

0 |

65 |

87 |

0 |

87 |

|

Coke |

44 |

33 |

77 |

40 |

51 |

91 |

61 |

57 |

118 |

|

Sulphur |

9 |

4 |

13 |

2 |

13 |

154 |

6 |

5 |

11 |

|

Benzene |

0 |

5 |

5 |

0 |

12 |

12 |

0 |

19 |

19 |

|

P-xylene |

0 |

2 |

2 |

0 |

55 |

55 |

0 |

90 |

90 |

|

Liquefied gas |

128 |

0 |

128 |

114 |

0 |

114 |

133 |

1 |

134 |

|

Heating fuel |

43 |

23 |

66 |

7 |

0 |

7 |

6 |

0 |

6 |

|

Other |

4 |

0 |

4 |

14 |

0 |

14 |

15 |

0 |

15 |

|

Total |

2,162 |

681 |

2,843 |

2,332 |

804 |

3,136 |

2,161 |

1,007 |

3,168 |

In accordance with the Technical Regulations of the Customs Union, starting from 2018, domestic refineries has been producing motor fuels of environmental classes C4 and C5

Quality of gasoline by the RoK refineries is as follows:

- Volume fraction of benzene is not more than 1 % for environmental classes K4, K5;

- Volume fraction of aromatic hydrocarbons is not more than 35 % for environmental classes K4, K5;

- Mass fraction of sulphur is not more than 50 mg/kg for class K4, not more than 10 mg/kg for class K5;

- Volume fraction of monomethylaniline is not more than 1 % for environmental class K4 and none for environmental class K5.

- Production of gasoline of environmental classes K4 and K6 does not involve metal containing additives (with iron, manganese, lead).

See more details about

operations and financial performance of the Company in the 2020 Annual Report at

https://kmg.kz/eng/investoram/reporting-and-financial-result/

2020 corporate milestones

PRODUCTION RESULTS

- On December 11, two wells were commissioned in East Urikhtau field.

- In 2020, a milestone for additional exploration of the operated projects was the free flow of pure oil from Triassic deposits, at 70 t/day, from NSV-11 well near the north-west wing of S.Nurzhanov field of Embamunaygaz JSC.

- In 2020, one of the important events for the operated prospecting and exploration projects was the free flow of pure oil from Jurassic deposits at up to 85 t/day from an exploration well at Bekturly East.

- For three oil refineries, processing depth of light petroleum products was improved to the average of up to 84.8% (POCR: from 86.3 % to 87.2 %; AR: from 75 % to 77.2 %; PKOP: from 84.8 % to 90.1 %), losses of all refineries reduced as compared to 2019.

- Oil was reliably and uninterruptedly supplied to the domestic market, exported and transited.

- First phase facilities were commissioned, construction of a main pump station and power generation facilities was completed; upgrade of the oil metering system at the Kenkiyak – Kumkol oil pipeline was completed as a part of the second phase of the Kenkiyak – Atyrau oil pipeline reverse project.

- Transportation by KMTF vessels and transshipment of cargoes through Prorva port for TCO FGP was completed before term. Total of 408 modules totalling to 279,859 tonnes were processed.

- The Beineu – Bozoi – Shymkent trunk gas pipeline reached its full capacity.

CONTRIBUTION TO ECONOMIC DEVELOPMENT

- The 2020–2021 Anti-Crisis Measures has been developed and are being implemented to reduce the adverse effect of the crisis on the Company.

- Because of the Anti-Crisis measures, financial performance of KazMunayGas turned out to be better than it was expected in the beginning of the pandemics. Positive free cash flow was reached following the results of the year.

- The Anti Crisis Measures cut expenses by 147 bln KZT (capital expenses reduced by 103 bln KZT, operational expenses reduced by 27 bln KZT, administrative expenses reduced by 17 bln KZT).

- The total debt in USD dropped by 3.4 % against the 10,030 mln USD as of December 31, 2019, and amounted to 9,690 mln USD as of December 31, 2020.

- Unprofitable and low margin projects were removed from the KMG investment portfolio.

- Capital expenses for investment projects reduced (expenses for development were cut by 29 bln KZT).

- KMG Euro bonds were successfully refinanced at 907 mln USD, this resolved the issue of major lump-sum debt repayments. The next major debt repayment will happen only in 2025.

- Thanks to the previous work in 2017–2019 to control and cut the debt, timely refinancing of major lump-sum repayments, improvement of the covenant package, higher liquidity management, optimised cost and reinforced financial stability, KMG managed to keep its credit ratings according to Moody’s, Fitch and SQP without asking for assistance from the state.

- The share of local content in procurement of goods, work and services is 71% for goods (the target is 60 %); and 86 % for work and services (the target is 80 %). Goods for 165 bln KZT or 68 % of all procured goods were procured from domestic producers under contracts valid less than 1 year according to SDE procurement plans.

- In 2020, 40 offtake contracts and 2 memorandums were entered into with domestic producers for the total of 13.56 bln KZT.

- In 2020, under contracts for up to 500 mln KZT, suppliers retained 22,600 jobs and created 1,623 new jobs.

- A group of measures to achieve zero tolerance towards corruption and fraud, which involved as many employees of the KMG Group as possible, made it possible to finish 2020 without a single corruption or fraud case.

- Information security activities, observation of basic cyber hygiene requirements, including those for remote work, prevented information security incidents, which could result in major damage for the Company.

- Measures implemented by KMG, SDEs and security contractors in 2020 ensured the appropriate physical security of KMG infrastructure, not allowing a single criminal branch to the trunk oil pipelines.

SOCIAL AND ENVIRONMENTAL PERFORMANCE

- During the COVID-19 pandemics, the KazMunayGas Group did not let production processes stop, did not downsize production staff and did not cut remuneration. The Company provided more than 6 bln KZT of charitable assistance to regions to fight the COVID-19.

- For the first time in its history, KazMunayGas managed to finish the year without work-related fatalities.

- In 2020, a 42 km long high and medium pressure gas pipeline was constructed to supply gas to five settlements (Masanchi, Karakemer, Sortobe, Bular batyr, Aukhatty) in Korday District of Zhambyl Region. The project provided natural gas for 10 settlements with more than 62,000 people, 7,177 residential houses, 29 social facilities, 243 small and medium businesses. Seven more settlements can be gasified in the future.

- The joint efforts of Turkestan akimat and KazTransGas Aimak JSC in 2019–2020 made it possible to gasify 100 % of Turkestan. More than 50,000 consumers has been connected to the gas supply networks. 26,200 families are already using natural gas by KazTransGas Aimak JSC in their houses.

- The social well-being index in the KMG Group grew from 72 % in 2019 to 74 % in 2020 (according to the research of November 2020 by Social Engagement and Communications Centre of Samruk–Kazyna JSC).

- KazMunayGas met all of its commitments under collective agreements despite the pandemics and low global oil prices.

- On several occasions, KazMunayGas paid for the forced downtime to employees of service companies, where work scopes dropped because of the reduced production.

- Despite the reduced expenses, work conditions of production workers continued to be improved. New dormitories were commissioned in Karazhanbas, Mangistaumunaygaz, a shift camp was constructed in Aktobe Region. Employees of Atyrau Refinery got the keys to 101 apartments as a part of the social support programme.

- It is the second year in a row when carbon footprint is being calculated and published in the CDP Climate Change Questionnaire, which resulted in KMG being given Climate Change Score C.

COMPANY’S MISSION AND STRATEGIC INTENTS

- Growing free cash flow and return on investments

- Appropriate business model and governance model

- Ethics, compliance, corporate culture

- Sustainability and environmental responsibility

* According to the JSC NC “KazMunayGas” Development Strategy until 2028, approved by the decision of the KMG Board of Directors dated October 4, 2018 (Protocol No. 14/2018).

ANTI CRISIS MEASURES AMONGST THE COVID-19 PANDEMICS

In order to mitigate effects of the COVID-19 crisis on the company, KMG has developed and is implementing the 2020–2021 Anti Crisis measures.

The main five areas of the Anti Crisis Measures which significantly mitigated the crisis effects on the Company:

- Operational model;

- Operational efficiency;

- Financial stability;

- Investment activities;

- Digital transformation.

Measure 1. Operational model

The operational model measures include:

- Optimisation of business processes;

- Revision of the organisational chart and optimization the KMG Headquarters.

During the 2020 crisis, KMG paid for the forced downtime to employees of service companies, where work scopes dropped because of the reduced production.

Outplacement, a socially responsible employee dismissal project. As a result, 25 % of the participants were employed within six months since the beginning of the project, and 12 % changed their occupation and started their own business, 93 % of the participants were satisfied with the outplacement programme.

Optimisation, debureaucratisation and enhancement of business process efficiency in KMG and in relationships with SDEs:

- A new procurement and contracting procedure was introduced;

- Typical competencies for SDE bodies were developed. At the moment, SDEs work to revise their Articles of Association according to the Typical Competences.

Measure 2. Operational efficiency

Measures to increase operational performance involve:

- Reducing oil production, primarily through stopping non-profitable wells;

- Reducing tariffs/prices and cutting scopes of contractors/suppliers throughout the KMG Group.

Production processes in the KMG Group were not allowed to stop during the COVID-19 pandemics.

KMG met all of its oil production commitments under OPEC+.

The Anti Crisis Measures cut expenses by 147 bln KZT (capital expenses reduced by 103 bln KZT, operational expenses reduced by 27 bln KZT, administrative expenses reduced by 17 bln KZT).

The KMG headquarters was optimized by 34 % in total, the staff was optimized from 729 to 480 people, all 22 managing directors were laid off, number of departments was reduced by 3.

Bonuses and company vehicles were cancelled, top management salaries were cut by 30 %.

Measure 3. Financial stability

Measures to support financial stability of KMG included:

- Optimising manageable expenses within the prime cost;

- Reducing the share of fixed costs;

- Optimising capital expenses (CAPEX);

- Keeping the debt burden at an appropriate level so that to cover possible cash shortages and investments.

In 2020, the debts of the KMG Group dropped by 341 mln USD, including early repayment. The debt is also observed to drop at the level of joint ventures for more than 1.1 bln USD, of which more than half are attributable to KMG Kashagan B.V.

KMG Euro bonds were successfully re-financed at 907 mln USD.

This resolved the issue of major lump-sum debt repayments. The next major debt repayment will happen only in 2025.

KMG managed to keep its credit ratings according to Moody’s, Fitch and SQP as a result of the previous work in 2017–2019 to control and cut the debt, timely refinancing of major lump-sum repayments, improvements of the covenant package, higher liquidity management, optimised cost and reinforced financial stability.

Measure 4. Investment activity

Two main aspects of investment activities were optimised:

- The list of assets to be divested was expanded.

- The investment projects portfolio was prioritised and included the most profitable projects which meet strategic goals of the Company.

Unprofitable and low margin projects were removed from the KMG investment portfolio.

Capital expenses for investment projects reduced (expenses for development were cut by 29 bln KZT).

Measure 5. Digital transformation

Prioritising the digital transformation projects portfolio resulted in net profit of 9.3 bln KZT in 2020, which is 127 % above the target because of the post monitoring projects. “Association KazMunayGas Exploration and Production” JSC and JSC National Company “KazMunayGas” and “Procurement Category Management”.

Four projects were launched: “Introduction of ABAI Information System:, “Introduction of Engineering Simulation System at RoK Refineries”, “Establishing a Multifunctional KMG Shared Service Centre and “Journey Management”. The expected effect from the introduction will amount to 72.4 bln KZT.

In order to reduce disease rates and minimise the spread of the virus, and to reduce effects on production processes, the necessary comprehensive measures were taken, corresponding methods and guidelines were developed and introduced, special activity plans were developed and approved. See more information in COVID-19 Response – Production Safety.

As part of the global fight against COVID-19, the Company provided the necessary assistance of 6.2 bln to local executive authorities and medical institutions. See more details in Our Contribution to the Fight against COVID-19.

CORPORATE GOVERNANCE

Pursuant to the RoK laws and KMG Articles of Association, the KMG corporate governance structure is as follows:

KMG bodies are:

The Board of Directors is engaged in general management of KMG activities, identifies priority activities, Company development strategy and reports to the General Shareholders Meeting for its management functions. The current activities are managed by the Management Board, which, in turn, reports to the Board of Directors.

Committees of the Board of Directors are established to review the most important matters and to issue recommendations for the Board of Directors. As of 31, December 2020, there were the following committees of the Board of Directors:

- Nomination and Remuneration Committee is established to address succession of the Board of Directors and the Management Board, evaluate performance of the KMG bodies, ensure efficient HR policy, salaries and remuneration system, and social assistance, professional development and training for KMG officials and employees.

- Strategy and Portfolio Management Committee is established to address development strategy and investment policy, KMG operational priorities, improvement of KMG investment attractiveness, KMG financial and economic planning and transformation monitoring.

- Audit Committee is intended to control the financial and economic activities, efficiency of the internal control, risk management and corporate governance systems, to address audit and financial reporting issues.

- Health, Safety, Environment, and Sustainability Committee is intended to address health, safety and environment, introduction of sustainable development and social & economic development philosophy, social commitments and programs, business continuity and environmental efficiency. This committee is responsible for initiation, in-depth review of and resolving on economic, environmental and social aspects of the impact caused by the Company.

Economic, Environmental and Social Responsibility

According to the Corporate Governance Code, the Board of Directors and the Management Board, within their competences, build and introduce an appropriate sustainability system, and officials and employees of all levels make their contributions to sustainable development.

As of December 31, 2020, responsibility for sustainable development in the executive body was distributed as follows:

- Deputy Chairman of the Management Board for Strategy, Investments and Business Development: establishing and introducing a sustainability management system to ensure observation of sustainable development philosophy; integrating sustainable development in key processes, development strategy and decision making processes of the Company.

- Deputy Chairman of the Management Board for Economy and Finances is responsible for economy of the Sustainable Development, including assistance with economic development within the company geography.

- Director of the Health and Environment Department: establishing and ensuring implementation of HSE strategy and policies of KMG, health, safety and environment.

- Director of the Human Resources Department is responsible for process implementation and management of manpower, human resources and social aspects of the Sustainable Development.

Before introduction of the new structure of KMG Headquarters on 01 July 2020, establishing and introducing a sustainable development management system to ensure observation of sustainable development philosophy, and integrating sustainable development in key processes, development strategy and decision making processes of the Company were the responsibility of the Managing Director for Sustainable Development. After introduction of the new structure of the KMG Headquarters, this position was discontinued and the powers were handed over to the Deputy Chairman on the Management Board for Strategy, Investments and Business Development.

The above officers report to the Chairman of the KMG Management Board. Accountability of the responsible officers for economic, environmental and social matters is governed in detail by internal regulations, internal control and business continuity procedures of the Company. Thus, according to the development plan, matters are regularly brought for review of the Management Board, which, in turn, reports to the Board of Directors. To review these matters during the BoD meetings, BoD committees issue recommendations for the BoD as follows:

- Comprehensive control over the functions and activities to improve corporate governance is the responsibility of the Audit Committee of the KMG Board of Directors;

- Initiating, deep review and decision making on economic, environmental and social aspects of the company impact, and following up on introduction of sustainable development in the Company is the responsibilities of the Board of Directors Committee for Health, Safety, Environmental and Sustainable Development.

Consultating stakeholders on economic, environmental and social matters

Stakeholders and Company’s supreme corporate governance body constantly consult each other on economic, environmental and social matters in various ways.

For instance, the Health, Safety, Environment, and Sustainability Committee of the Board of Directors (hereinafter − the Committee) is in charge of general management of the above officials. In 2020, 4 meetings of the Committee were held, which reviewed 40 matters and issued 98 resolutions and instructions.

The Committee generates and issues to the Board of Directors recommendations regarding:

- Health, safety and environment;

- Integration of the sustainable development philosophy into KMG strategic planning and social & economic development;

- KMG social commitments and programs under the existing subsoil use contracts;

- KMG business continuity;

- Environmental efficiency of KMG.

The main focus of the Committee in 2020 was health, safety, environmental, strategic governance of ESG (Environmental Social Governance) and introduction of a sustainable development system.

The key items of the Committee agenda in 2020 may include:

- Climate change (greenhouse gas emissions, CDP (Carbon Disclosure Project), WDP (Water Disclosure Project).

- ESG rating (Environmental – Social – Governance) of KMG.

- Environmental rating of the KMG Group.

- Getting approval of the List of UN Sustainable Development Priorities for KMG.

- Introduction of a sustainable development system in KMG and its business units, incorporating the sustainable development philosophy into the key business processes.

- Establishing KPIs for certain managers of the Company associated with Sustainable Development.

- COVID-19 reports for KMG and measures taken by the KMG Group to prevent spread of COVID-19.

- Health, safety and environmental reports of KMG.

- Recording potential safety threats, preventing highly hazardous incidents for life and health of employees.

- HSE management of contractors in the KMG Group.

- Researching and preventing fatalities, traffic accidents and safety incidents, holding managers responsible for incidents.

- Social policy of the KMG Group, ensuring social stability in KMG facilities and social responsibilities of the KMG Group.

- Results of the anonymous HSE poll conducted by the KMG Internal Audit Service in 2019.

- Training for KMG employees to develop skills and competencies in ethical procedures and philosophy.

- Increasing efficient use of associated petroleum gas in the KMG Group.

In addition, in 2020, the Committee reviewed and approved the following main documents:

- Corporate Standard – Single Health and Safety Management System in JSC NC “KazMunayGas”;

- Corporate Standard for Production Process Safety Management in JSC NC “KazMunayGas”;

- Manual for Sustainable Development System Management in JSC NC “KazMunayGas”.

KMG officials and employees were regularly invited to take part in the Committee’s meetings without the voting rights. The KMG Board of Directors accepted every recommendation developed by the Committee.

A wide range of stakeholders is

consulted on economic, environmental and social matters via Company’s website, public relations

service (press service), and through the annual Sustainability Report which is the central means of

communication between KMG and its internal and external stakeholders for sustainable development

disclosures. At the same time, KMG has various communication methods in place to be able to have appropriate

dialogues with stakeholders and the Company. For example, detailed information for investment community is

published at https://kmg.kz/eng/investoram/reporting-and-financial-result/,

employment matters are covered at http://work.kmg.kz,

confidential reporting system is implemented through the trust system at doverie@kmg.kz;

functional interactions are also provided for activities of the Ombudsman at ombudsman@kmg.kz,

safety and environment matters at hse@kmg.kz, and sustainable development at

sustainability@kmg.kz.

GOVERNANCE BODY AND ITS COMMITTEES

As of December 31, 2020, the KMG Board of Directors includes:

- Christopher John Walton, Chairman of the Board of Directors, Independent Non-Executive Director

- Alik Aidarbayev, Chairman of the KMG Management Board;

- Timothy Glenn Miller, independent non-executive director;

- Philip Malcolm Holland, independent non-executive director;

- Uzakbay Karabalin, Representative of JSC Samruk-Kazyna

- Almasadam Satkaliyev, Representative of JSC Samruk-Kazyna

- Anthony Espina, Representative of JSC Samruk-Kazyna

As of December 31, 2020, Committees of the KMG Board of Directors are represented by:

Audit Committee

- Christopher John Walton, Chairman

- Timothy Glenn Miller

- Philip Malcolm Holland

Strategy and Portfolio Management Committee

- Philip Malcolm Holland, Chairman

- Christopher John Walton

- Timothy Glenn Miller

- Uzakbay Karabalin

- Anthony Espina

Nomination and Remuneration Committee

- Philip Malcolm Holland, Chairman

- Christopher John Walton

- Anthony Espina

Health, safety, environment and sustainable development committee

- Timothy Glenn Miller, Chairman

- Christopher John Walton

- Uzakbay Karabalin

The Company complies with the Corporate Governance Code in terms of the number of independent directors in the Board of Directors, according to which there shall be up to 50 % of independent directors in the Board of Directors.

Resolution of the Management Board of JSC Samruk–Kazyna dated August 17, 2020 (minutes No.30/20) elected new 7 members of the Board of Directors, including three independent directors. The Chairman of the Board of Directors is an independent director.

As of December 31, 2020, the KMG Board of Directors has the following structure:

- 3 independent directors;

- 3 representatives of Samruk–Kazyna JSC;

- 1 manager of the executive body (Chairman of the Management Board).

Out of seven members of the Board of Directors, three people are the citizens of the Republic of Kazakhstan, three are the citizens of UK, one is the citizen of the USA.

Term of office of the Board of Directors is three years. Members of the Board of Directors can be re-elected for more than six years in a row, if specifically considered, with regard to the need to renew the Board of Directors. An independent director cannot be elected to the Board of Directors for more than nine years in a row, and an independent director shall be elected in the Board of Directors every year, supported by a detailed explanation why to elect this specific member of the Board of Directors and how this factor affects independence of decision making. The Board of Directors and its Committees maintain the balance of skills, experience and knowledge to ensure the independent, unbiased and efficient decision-making process in the interests of KMG and in view of equal treatment of all shareholders and sustainable development principles. Members of the Management Board, except for the Chairman, cannot be elected to the Board of Directors, and the Chairman of the Management Board cannot be elected as the Chairman of the Board of Directors. For more details on the members of the Board of Directors, visit KMG website: https://www.kmg.kz/eng/kompaniya/korporativnoe_upravlenie/sovet_direktorov/

NOMINATION AND SELECTION OF THE GOVERNANCE BODY

Procedure for Nomination and Selection of Candidates to the Board of Directors

Candidates to the members of the Board of Directors are nominated and selected as defined by the Articles of Association, KMG Corporate Governance Code and other regulations, by the General Shareholders Meeting together with the Chairman of the Board of Directors, and Chairman of the Board of Directors Committee for Nomination and Remuneration, and according to the philosophy of transparency, fairness and professionalism in search and selection and nomination of candidates.

In 2018, the Matrix of Skills and Competencies for the Members of the Board of Directors of JSC NC “KazMunayGas” was developed, which was approved by resolution of the Committee for Nomination and Remuneration on 30 March 2018 (Minutes No.5/2018). The Matrix was filled in by members of the Board of Directors to identify competences which are needed for the KMG Board of Directors, and to issue shareholder recommendations for candidates to the KMG Board of Directors. The Summary Matrix is updated when new members of the KMG Board of Directors are elected. Resolution of the Management Board of JSC Samruk–Kazyna dated 17 August 2020 (minutes No.30/20) elected new members of the Board of Directors. The Matrix was submitted to the new members of the Board of Directors – T.G. Miller and Ph.M Holland. The filled in Matrices helped identify the most essential knowledge, experience and competences for selecting and nominating new candidates for the KMG Board of Directors. On 08 December 2020 (Minutes No.12/2020), the Nomination and Remuneration Committee, following the discussion of the updated summary Matrix, issued a recommendation to continue working with Samruk–Kazyna JSC to search for an independent director to be elected not later than in Quarter 3 of 2021, and identified criteria for a candidate including independence, citizenship, gender diversity and professional qualifications.

Members of the Board of Directors are elected from among the suggested candidates to become shareholders representatives or other persons. Candidates to the Board of Directors are reviewed during meetings of the Board of Directors Committee for Nomination and Remuneration and shall have knowledge, skill and experience as necessary to fulfil their functions and to ensure long term value and sustainability, and shall have spotless business reputation. The Chairman of the Board of Directors is elected by the General Shareholders Meeting. Independent directors are selected according to the approved Guidelines for Selection of Independent Directors for Companies within Samruk–Kazyna Group.

CONFLICT OF INTERESTS

The basic conflict of interests settlement processes are reflected in the Policy for Settlement of Conflict of Interests for Employees and Officers of KMG and SDEs approved by the KMG Board of Directors, and the Code of Business Conduct.

Observation of this policy is the responsibility of each company Employee regardless of position, and of each company Officer.

At the moment, the Company has implemented a Procedure for initial disclosure of information about potential conflict of interests among employees and/or officials being hired/appointed/taking a new office. Such Disclosure shall include:

- Beneficial ownership/share participation and management in counterparties/competitors of KMG and SDEs;

- Participation in single member and joint bodies of counterparties or competitors of KMG and SDEs;

- Interactions with counterparties of KMG and SDEs;

- Intention to acquire assets and/or securities owned by KMG and/or its SDEs, etc.

Checks are conducted for conflict of interest and observation of requirements and procedures of KMG policies and/or other compliance documents, including attributes of affiliation of the Fund Group officials with persons being considered as candidates to be hired, appointed for management positions, and when entering into interested party transactions. The above persons additionally provide their Consent with the anti-corruption restrictions according to the Anti Corruption Law.

ROLE OF THE GOVERNANCE BODY IN IDENTIFICATION OF GOALS, VALUES, MISSION AND STRATEGY

The Board of Directors shall prioritise activities, approve and monitor implementation of the development strategy, including the goals, values, mission, and economic, environmental and social development related policies and tasks as agreed with the shareholders based on suggestions developed by the executive body.

Strategic Session (a separate meeting of the Board of Directors for Development Strategy) was held on 20 November 2020, which reviewed implementation of the KMG 2028 Development Strategy, which had been approved in 2018, in view of the changed environment and anti-crisis measures. Members of the KMG Board of Directors and the Management Board had a constructive discussion of the most important subjects. Specifically, they discussed the valid KMG Development Strategy, including prospects and sustainable development of KMG.

According to the KMG Corporate Governance Code and Development Strategy, long-term, sustainable development is one of the main strategic goals and objectives of KMG, which is consistent with the vision of Samruk–Kazyna JSC, development strategy of the Republic of Kazakhstan and agenda or the international investment community.

In 2020, the KMG Board of Directors Committee for Safety, Health, Environment and Sustainable Development approved 6 sustainable development priorities out of 17 Sustainable Development Goals. Those included:

- Ensuring healthy lifestyle and facilitating well-being for everyone in any age;

- Providing public access to cost-efficient, reliable, sustainable and modern sources of energy for everyone;

- Facilitating progressive, comprehensive and sustainable economic growth, complete and productive employment and decent work for everybody;

- Creating a stable infrastructure, promoting comprehensive and persistent industrialization and innovation;

- Taking urgent measures to fight climate change and its consequences;

- Protecting and restoring shore ecosystems, promoting their efficient use, efficient use of forest, combating desertification, stopping and reversing the loss of biodiversity.

The year 2021 and the subsequent years will be dedicated to practical implementation of activities to achieve these goals.

The Board of Directors acknowledges the high priority of ecology and environmental protection, life and health of Company employees and contractors of all production facilities, development of human potential and commitment to recognised Global Sustainable Development Goals by delegating these matters to the Committee of the KMG Board of Directors for Safety, Health, Environment and Sustainable Development.

COMPETENCE AND PERFORMANCE REVIEW OF THE GOVERNANCE BODY

Collective knowledge of the members of the governance body

Members of the Board of Directors are committed to regular improvement of their skills and professionalism, including economic, environmental and social management skills. The Nomination and Remuneration committee regularly reviews the current balance of skills and knowledge of the members of the Board of Directors. Regular updates of training of the members of the Board of Directors are published on the Company website.

KMG employees pass periodic trainings in sustainable development, ethics and compliance, and other regular workshops and sessions according to components of the corporate governance.

Governance Body performance review

A provision has been developed under the Code for performance review of the Board of Directors, Committees of the Board of Directors, Chairman and members of the Board of Directors and Corporate Secretary of KMG (the Provision). The Provision provides that the Board of Directors, Committees and members of the Board of Directors shall be annually reviewed as a part of a structured process approved by the Board of Directors. At least once in three years, such review shall involve an independent professional organisation.

An independent review involving PricewaterhouseCoopers LLP (PwC) took place in 2017, and the results were used to establish the new composition of the KMG Board of Directors. Also in 2018, PwC was involved for independent corporate governance assessment in KMG based on the Method, which included, but was not limited to, performance review of the Board of Directors.

Therefore, the next independent performance review of the Board of Directors is scheduled for 2021. With that, in 2020, KMG conducted self-assessment of the members of the Board of Directors following 2019 in accordance with the Code and the Provision, the results were then reviewed and discussed during a closed meeting of the Board of Directors, which was only attended by the members of the Board of Directors and the Corporate Secretary. The discussion included demonstration of self-assessment results of members of the Board of Directors, skills and competences. Some activities to improve these were initially included in the KMG 2019–2020 Detailed Corporate Governance Improvement Plan (DCGIP), which was later revised for further improvement of the Board of Directors performance.

On 08 December 2020, meeting of the Board of Directors Committee for Nomination and Remuneration reviewed the matter of the 2020 self-assessment, where the Corporate Secretary presented information about the status of DCGIP activities following the self-assessment of 2019.

The following should be noted from among DCGIP activities to improve performance of the Board of Directors on indicators which, according to the members of the Board of Directors, required improvement:

- Resolution of the Fund Management Board dated August 17, 2020 (Minutes No.30/20) elected seven (7) members of the KMG Board of Directors because of expiration of the terms of office. The new members of the Board of Directors – Ph.M. Holland and T.G. Miller, filled in a Skill and Competence Matrix, and the Committee for Nomination and Remuneration reviewed the corresponding summary (Minutes No.12/2020). Following the discussion, they issued a recommendation to continue the search for an independent director and the main requirements for the candidate.

- Meeting of the KMG Board of Directors Committee for Nomination and Remuneration reviewed the matter of the Policy of Succession of the KMG BoD Members (Minutes No. 5/2020 dated March 31, 2020). This was the first step to develop a succession plan for the members of the KMG Board of Directors. Following review of the summary skill and competence matrices during the meeting of the Nomination and Remuneration Committee, development of the succession plan for the members of the Board of Directors is expected to be continued.

- During the Information Session for the KMG BoD Development Strategy on November 20, 2020 No.14/2020, C.D. Walton, the Chairman of the BoD in his welcoming remarks focused the attention on practicability of updating the valid KMG Development Strategy, commitment of the KMG BoD and Management Board to the KMG Development Strategy, sufficiency of financial and human resources to achieve the approved strategic goals of the Company, and presented an extensive report.

- According to the updated Provision on the BoD Audit Committee, functions of the Internal Control and Risk Management Committee were revised to include: “The Committee shall assess the level of confidence in the risk management and internal control systems, including internal financial controls, and whether they are sufficient for the Board of Directors to resolve that they perform effectively.”

- The Board of Directors shall clearly and constructively respond in the context of crisis, including the current crisis; In the context of crisis, the Board of Directors made certain resolutions on the matters, including, but not limited to, an anti-crisis programme, Comprehensive Business Continually Plan, financial stability, downsizing the total headcount, organisational chart of the KMG headquarters, reducing remuneration, etc.

The Crisis Management Team was activated in February 2020 because of the onset of COVID-19.

Management of economic, environmental and social impacts

The KMG Board of Directors plays a crucial role in management of economic, environmental and social impact and the associated prospects. The Company quarterly and annually assesses risks under the approved risk management method, including economic, environmental and social risks. Based on the identified risks, the relevant action plans are developed and implemented to prevent, monitor and eliminate such risks. Specifically, the competences of the Board of Directors include defining the corporate risk management policy, approving risk register and risk map, critical risk management activities plan, total risk appetite, tolerance to each key risk, approving the Risk Report and business continuity documents of KMG.

The KMG Board of Directors uses the “top-down” approach to ensure that appropriate behaviour standards are followed; the basic document which governs ethical standards adopted in the Company is the KMG Code of Business Conduct, which is approved by the Board of Directors. During the reported period, the KMG Board of Directors approved the updated KMG Code of Business Conduct. Observation of this Code is one of the steps towards reinforced reputation of the Company, sustainable development and achievement of strategic goals of KMG.

In the reported period, the Committee of the KMG Board of Directors for Health, Safety, Environment and Sustainable Development instructed the KMG Ombudsman to ensure that 100 % of KMG employees pass the training to develop skills and competencies in ethical procedures and philosophy. In addition, the KMG Board of Directors Committee for Health, Safety, Environment and Sustainable Development builds and enhances the culture of safety, health, environment and sustainable development.

Stakeholders are consulted with to assist the superior corporate governance body with identification and management of economic, environmental and social impacts, risks and opportunities, as required, during meetings of the KMG Board of Directors with representatives of the main shareholder of KMG (Samruk–Kazyna JSC), meetings of the Audit Committee of the KMG Board of Directors with the external auditor of KMG (Ernst & Young), and during meetings of the KMG Board of Directors and its committees with initiators of the agenda items (managers of KMG).

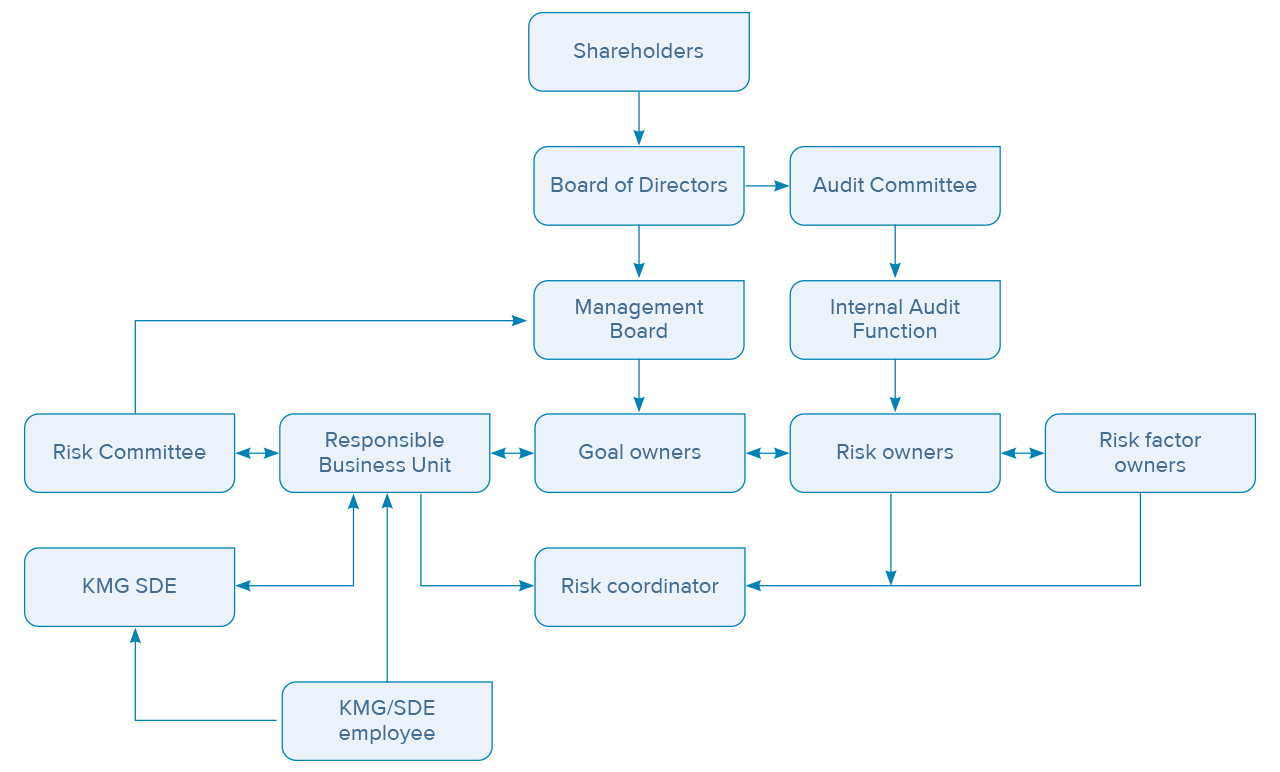

RISK MANAGEMENT PROCESS

The CMRS is designed as a consistent and clear structure to manage risks associated with the activities of KMG. KMG has built a vertical risk management process and performance of the risk management system on all management levels from the top level (KMG) to the level of line management (production business units of subsidiaries).

Each officer shall properly review risks when taking a decision.

Risks are assessed using qualitative and quantitative tools in view of the probability and impact of a materialised risk.

The CRMS process is implemented through seven interconnected CRMS processes which are integrated into management business processes of the KMG Group.

- Establishing goals (linking strategic, mid-term and short-term planning targets);

- Identifying risks/risk-factors (identifying exposure of all activities and business processes of the KMG Group to risks, which may have adverse effect on the ability to reach the planned targets and implement the goals);

- Evaluating and analysing risks/risk factors (to identify how risks/risk factors affect achievement of KPIs); Work-related/non-work-related risks and corresponding risk-factors are analysed according to probability of materialisation and the degree of impact (potential damage);

- Managing risks (developing and implementing measures to reduce adverse consequences and/or probability of inherent risks and corresponding risk-factors, or get financial compensation for the damages associated with the risks of KMG Group activities);

- Monitoring and reporting (monitoring dynamics of the risk parameters and efficiency of risk management activities and controls). The monitoring is provided quarterly by the KMG Risk Management and Internal Control Unit, a consolidated Risk Report covering KMG SDEs is brought for review of the Board of Directors quarterly);

- Informing and communicating (to provide reliable and timely information about risks to participants of the risk management process, improve awareness about risks, risk response methods and tools. The corresponding information is identified, recorded and provided in the established formats and on dates for employees to be able to efficiently fulfil their functions);

- Internal environment (implementing the above components of the risk management process to facilitate development of the risk culture in the KMG Group based on the appropriate “top” approach, high awareness about risks, responsibility of risk/risk-factor owners, active risk management and timely reporting. KMG is committed to build an adequate CRMS organisational chart to be able to implement effective corporate governance, ensure appropriate division of duties, authority and responsibility for identification, assessment, management and reporting or risks.)

KMG CRMS organizational chart

The following documents are brought for review of the KMG Board of Directors at least once a year:

- Suggestions regarding Company’s risk appetite;

- Consolidated risk register;

- Risk map;

- Company risk management activity plan.

In addition, the KMG Board of Directors quarterly reviews the Risk Report (consolidated risk report covering KMG SDEs), including the risks of injury, environmental, industrial, social risks in the regions, risks of the COVID-19 pandemic, geological, tax, reputational, financial risks, cyber risks, compliance risks and other key risks) which are reviewed properly and discussed fully. The Board of Directors takes appropriate measures to bring the current risk management and internal control system (RMICS) in line with the philosophy and approaches established by the Board of Directors.

Efficiency of risk management processes

Risk management in KMG help prevent risk events, which affect achievement of strategic and operational goals, and limit their impact should they occur. Risk management is an integral part of the KMG strategic planning, corporate government and maintaining financial stability.

Risk management approach, including management of tax risks, is established by the Corporate Risk Management System (CRMS).

KMG has integrated the CRMS into the key business and management processes of the company. The CRMS is intended to achieve the appropriate balance between the growing value of KMG, its profitability and risks.

The CRMS is the core component of the corporate governance system, which serves to identify, evaluate and monitor all major risks (including tax risks) in a timely manner, and to take timely and adequate measures to mitigate the level of risks.

The CRMS of KMG and its subsidiaries and dependent entities is applicable to all activities of KMG.

Economic, environmental and social overview

During each scheduled meeting, the Board of Directors hears the health, safety and environmental information of KMG. In addition, in 2020, the Board of Directors reviewed minimisation of compliance risks, influence of COVID on KMG activities (different aspects, including dropping oil prices). The Board of Directors and the Audit Committee quarterly review risk reports.

On multiple occasions during the reported period, members of the Board of Directors discussed the current situation with the spread of COVID, oil price wars between major international oil exporters resulting in drastic decline of the economy in general and in Kazakhstan in particular. Members of the Board of Directors emphasised that it was important for KMG in the current situation to care for its employees and business.

Role of the superior corporate governance body in preparation of the Sustainability Report

According to the Articles of Association of the Company, the Sustainability Report shall be approved by the KMG Board of Directors.

A KMG body which checks and recommends the KMG BoD to approve the Sustainability Report is the KMG Board of Directors Committee for Health, Safety, Environment and Sustainable Development.

Informing critical issues

The KMG Board of Directors is informed about critical issues through regular reports of Company activities, including but not limited to, key activity changes report of the Chairman of the KMG Management Board, HSE information, preliminary report of financial and business performance, report of interested party transactions resolved on by the Management Board, strategy performance status overview, key performance indicators and investment projects, KMG Consolidated Development Plan Implementation Report, risk report, report of resolutions of the Board of Directors, and reports of Chairmen of the BoD Committees.

In addition to the above reports, the BoD from time to time identifies matters which need to be informed on immediately, such as current situation in the KMG Group, including COVID-19 situation, operational activities, etc., financial performance, major HSE incidents in the KMG Group, including fire reports (even if such events occurred after the reported period). The BoD Committee for Health, Safety, Environment and Sustainable Development regularly reviews and discusses reports of introduction of the Sustainable Development System in KMG and its business units, and incorporation of the Sustainable Development philosophy in key business processes, and information about status of improving ESG rating (Environmental – Social – Governance).

Nature and number of critical issues

During review of KMG HSE information, which is reviewed during each meeting in presentia, the Board of Directors instructed to immediately inform the members of the Board of Directors about any HSE incident in the KMG Group regardless of the reported period. In addition, the Board of Directors demanded details of a HSE incidents investigation procedure and to develop an activity plan to minimise the incidents in the KMG Group. The Board of Directors instructed the KMG Management Board to prepare an activity plan describing negative factors of the changed environment (COVID influence, falling oil prices, reduced gas export and resulting losses from supplies of gas to the domestic market), activities to respond to such factors, dates and involvement of the Board of Directors.

The Board of Directors takes active part in the handover of KazTransGas JSC to Samruk–Kazyna JSC, and in discussion of potential risks for KMG.

During the quarterly discussion of the Risk Report, it was instructed to prepare suggestions to arrange a simulation of unknown risks and scenarios. The Board of Directors also instructed to analyse reputational risks and liquidity risks in view of the current fall of oil prices and risk management measures. The Board of Directors was informed how COVID influenced activities of KMG.

When discussing financial and business performance reports of KMG, the Board of Directors instructed to identify reasons for the reduced net profit.

The members of the Board of Directors weekly receive information about impact of COVID-19 on activities of the KMG Group.

The Board of Directors received the results of benchmarking for competitive analysis of the main indicators of KMG refineries and situation with employment in Zhanaozen.

Remuneration policy

Remuneration for the members of the KMG Board of Directors is established based on resolution of the Management Board of Samruk–Kazyna JSC as agreed with the member of the KMG Board of Directors.

Remuneration of the members of the Board of Directors includes a fixed salary and extra remuneration.

The extra remuneration includes remuneration for chairing the Board of Directors, chairing a committee of the Board of Directors, participation in a committee of the Board of Directors, participation in a meeting initiated by the Chairman of the KMG Board of Directors and/or representative of the Samruk–Kazyna Management Board, Chairman of the KMG Management Board.

On August 17, 2020, Samruk Kazyna JSC resolved to pay only the fixed salary and extra remuneration for chairing the Board of Directors. This resolution cancelled the extra remuneration for chairing a committee of the Board of Directors, participation in a committee of the Board of Directors, participation in a meeting initiated by the Chairman of the KMG Board of Directors and/or representative of the Samruk Kazyna Management Board, Chairman of the KMG management Board.

Remuneration establishing process

In accordance with the Corporate Governance Code, “remuneration for members of the Board of Directors shall be sufficient to attract, keep and motivate each member of the Board of Directors of a level as required for successful management of the company. Remuneration for a member of the Board of Directors of a company is established using a method developed by Samruk–Kazyna JSC in view of the expected positive effect for the company from participation of this person in the Board of Directors. Also, in accordance with the Corporate Governance Code, no one shall be involved in making a decision regarding his/her own remuneration.

Remuneration establishing procedure is defined by Samruk Kazyna JSC. Resolution of Samruk–Kazyna JSC dated 26 September 2016 (minutes No.35/16) approved the Guidelines for Selection of Boards of Directors of Companies within Samruk–Kazyna JSC, which describes, among other things, how to establish remuneration for members of the Board of Directors. According to Section 3 of the Remuneration and Compensation Guidelines, remuneration is established according to responsibilities of a member of the Board of Directors, scale of company activities, long-term goals and objectives. Remuneration is paid to independent directors. Remuneration for representatives of Samruk–Kazyna JSC in the Board of Directors of a company is based on resolution of the Samruk–Kazyna Management Board.

KMG does not involve advisors to establish remunerations.

With that, following the independent corporate governance assessment for KMG in 2018, which was procured by the KMG shareholder represented by Samruk–Kazyna JSC, the advisor gave the following recommendation” “During the Board of Directors performance review, consider how remunerations of members of the Board of Directors are consistent with their individual contributions to improvement of performance of the Board of Directors. Arrange an information session involving members of the Board of Directors to have an open discussion of remuneration of the Board of Directors. Clearly identify consequences of inadequate performance of duties and communicate them to the members of the Board of Directors. For example, low efficiency of members of the Board of Directors may result in early termination of their authority or not being able to be re-elected.”

This recommendation was reflected in one of the DCGIP activities, which in 2020 included an information session for the members of the KMG Board of Directors as a part of the meeting of the Committee of the KMG Board of Directors Committee for Nomination and Remuneration on April 25, 2020 (Minutes No.6/2020). The agenda of the Committee included suggestions to revise composition and remunerations of members of the KMG Board of Directors. Results of the discussion of the Board of Directors were communicated to Samruk–Kazyna JSC in a letter from KMG. The Company intends to take further measures to fulfil the advisor’s recommendation in 2021, after KMG Board of Directors performance review, as a part of the independent KMG corporate governance assessment procured by the main shareholder of KMG.

Involvement of stakeholders in salaries

Remuneration establishing procedure is based on resolution of Samruk–Kazyna JSC Management Board. According to the Guidelines for Selection of Boards of Directors for Companies within Samruk–Kazyna JSC, which among other things, describe how to establish remunerations for members of the Board of Directors, remuneration is established in view of the duties of a member of the Board of Directors, scale of company activities, long-term goals and objectives. Remuneration is paid to independent directors. Remuneration for representatives of Samruk–Kazyna JSC in the Board of Directors of a company is based on resolution of the Samruk–Kazyna Management Board.

When deciding on remuneration for members of the KMG Board of Directors, the Committee for Nomination and Remuneration, according to the Corporate Governance Code, shall have the right to recommend remuneration for members of the KMG Board of Directors.

See more details about GRI 102-15, 102-30, 102-35,102-36,102-37,102-38,102-39 (risk management, remuneration of the board of directors) in the KMG 2020 annual report on the KMG website athttps: https://kmg.kz/eng/investoram/reporting-and-financial-result/

DIGITAL TRANSFORMATION

2020 results

KMG understands that digitalization is not a matter of far future, it is a necessary element of any industrial company today. The Company is intending to continue digitalization, but in a selective and reasonable manner, where it will have a considerable effect.

In 2020, Samruk–Kazyna JSC identified production improvements as the focus of the Digital Transformation Programme. This approach defined structure of a new KMG Transformation Portfolio and launched the search for new projects.

Targeted Digitalization strategy will be developed to support necessary transformations to reach the SDG. Digital technology will help automate work processes, analyse and optimise use of energy and materials to minimise climatic impact, ensure safe work conditions for employees.

As the global economy is declining due to the COVID, digital transformation is seen as one of the lines within the anti-crisis strategy of KMG. The current Programme Portfolio includes projects intended to cut expenses, enhance transparency of business processes, develop a culture of continuous improvement and introduce digital solutions in work. The Programme is focused on exploration, production and processing of oil.

In 2020, the digital transformation project portfolio included four projects: “Introduction of ABAI Information System” for production assets, “Introduction of Engineering Simulation System at RoK Refineries”, “Establishing a Multifunctional KMG Shared Service Centre and “Journey Management”.

For example, ABAI is an information system which uses big data analytics and artificial intelligence to be able to cut costs for core exploration and production processes. In 2020, technical solutions were developed for 5 modules, which will be introduced in subsidiaries starting from the next year. For example, it is planned to launch a system for continuous corrosion monitoring of aboveground equipment to be able to cut costs for chemicals and reduce the accident rate.

The Journey Management project is intended to introduce a single system to acquire and process data from sensors on vehicles and special equipment by 9 parameters including the use of safety belts. This project also includes a motivation system for drivers, which will promote better safety and driving culture.

Lean 6 Sigma is aimed at sustainable development. The programme provides conditions to motivate employees and suggest improvements for current processes. Therefore, Lean 6 Sigma promotes the culture of lean management and changes people’s attitude to their daily work. 50 such projects were introduced in KMG in 2020. For example, consumption of fuel and energy at Pavlodar Refinery was reduced by selecting an appropriate duty for the furnace. The economical effect from this project amounted to 76.9 mln tenge.

Goals and objectives for 2021

According to company development priorities, Digital Transformation will be focused on the following initiatives:

- Environment – emissions control and resource saving;

- Health and safety – preventing injuries and control of COVID-19;

- Reliable and stable production – introduction of digital initiatives to maintain work processes at refineries;

- Initiatives to cut costs – improving profitability of production.

Searching for new digital transformation initiatives according to the identified areas will be done through the Bank of Ideas, the single platform which is expected to be launched for all KMG employees. The main objectives of the Bank of Ideas is to involve employees in resolving current issues, use creative potential of innovators to address socioeconomic and work tasks.

Digital transformation of KMG supports transformations as required to reach SDGs through upgrades of infrastructure and retrofitting industrial facilities by making them resilient by improving efficiency of resources and increased use of clean and environmentally friendly technologies and production processes (SDG 9).

Digitalization projects of Oil Refining and Petrochemistry Division

PC-based training simulators

To improve quality of employees’ work in normal and abnormal situations, improve reliability of units and prevent unscheduled shutdowns, the RoK Refinery Personnel Training and Qualification Project Using PC-Based Training Simulators (TS) has been implemented since 2019. The project is aimed at development of a dynamic process model based on a mathematical process model and visualization of a process unit. Visualisation is provided by: 1) Fully replicated interface and logic of distributed control systems (DCS) 2) Displaying the actual equipment in 3D or panoramic interface. Unit operators regularly master abnormal and normal conditions (shutdown/start) in the simulated conditions of the training simulators.

Upgrade and retrofitting of PKOP included commissioning of TSs for residual fluid catalyst cracker (RFCC), catalyst cracking hydrotreater (Prime G+), desulphurization of saturated and unsaturated liquefied petroleum gas (Merox), short cycle adsorption (SCA-2) and sulphur production units.

The project, which was initiated in 2019, covers eleven process units at AR, nine POCR units and one PKOP unit.

In 2019–2020, the project included commissioning of TSs for delayed cokers, isomerisation unit and naphta splitter, diesel hydrotreater and cerosene hydrotreater of POCR, catalyst reformer of PKOP, catalyst crackers (FCC), catalyst reformers (CCR) and aromatic hydrocarbons production complex (PX) of AR.

Guidelines were also developed and approved to apply TSs for training and knowledge assessment of refineries personnel. The refineries appointed trainers in charge of the training simulators, training, development of scenarios and knowledge assessment using TSs.

Production personnel of refineries pass regular trainings using TSs under the approved training curricula, training schedules, ready scenarios of emergencies and normal conditions.

Advanced process control system

A pilot project of advanced process control system was commissioned for ELOU-AT-2 unit of AR to implement the business objective of unit process automation. This system is known worldwide as the Advanced Process Control (APC).

The APC acts as an auto pilot, maintaining process conditions of the unit within the pre-set limits. It automatically monitors constant parameters of unit load, temperatures of columns and furnaces, quality parameters of flows leaving the unit. This reduces human factor in process control.

After introduction of the APC, dispersion of quality parameters reduced by 67 % for gasoline and by 73 % for diesel. The APC increases gasoline yield by approaching the gasoline boiling temperature as close as possible, and increases diesel yield by approaching the target pour point.

The project lasted for about a year: since April 2019, the AT-2 unit was inspected, equipment was designed and installed, the APCS was tested and integrated with the distributed control system (DCS). Dedicated AR specialists and unit operators were trained in work with the system. The system operates around the clock, it is now an integral part of the unit control, just as the DCS.

Introduction of the APCS on AT-2 unit had considerable effect. Yields of gasoline and diesel increased by 0.32-0.36 % (to 6.5 thousand t), which amounted to about 350 mln KZT/year.

Since the pilot is so successful, the system will be introduced at AVT-3 unit of AR in 2021, and at the catalyst cracker in 2022. After that it will be introduced for other AR units. In 2022–2023, the APC is scheduled to be replicated at PKOP.

3D plot plan Refinery engineering data management system

Digital Plot Plan and 3D Model of RoK Refineries is being implemented to build a high precision, digital refinery plot plan as a basis for a “digital twin”.

The project includes:

- Laser scanning of all facilities,

- Digitalization of all technical documentation for refineries,

- Building a digital 3D model of plants based on point clouds,

- Introducing “Digital Plot Plan” software, a multifunctional information system intended to store, analyse, process and visualise engineering data.

The project is not only intended to introduce a standalone digital plot plan and 3D model of a refinery. The main goal is to integrate the 3D model into daily business processes of the refinery. The future users of the product include not only employees of production assets upgrade department, but also process engineers, mechanical engineers, repair schedulers, reliability experts. In the process of implementation, the initial scope of the project was expanded and included an engineering data management system and an informational standard. It also includes integration of the new system with the repair scheduling system – IBM Maximo.

The digital plot plan will allow the system users to get updates about production assets, cut time and costs for engineering, increase production safety and reliability of assets.

Introduction of the digital model and plot plan at AR and POCR is scheduled on the first half of 2021.

Digitalization of Kazakhstan Petrochemical Industries

Since July 2018, JSC NC “KazMunayGas” has been constructing the first gas chemical complex in Atyrau region – Kazakhstan Petrochemical Industries (KPI).

The polypropylene production plant (KPI LLP) is the first phase of the Integrated Gas Chemical Complex (IGCC), which is scheduled for start-up in 2021. It will produce 500,000 tonnes of products per year. The second phase is the polyethylene production plant.

KPI is a new industrial facility which can be built from scratch, as a completely digital asset.

The majority of major downstream and chemical companies (BASF, BP, ADNOC) have digitalised their assets progressively, over a long period of time. Kazakhstan does not yet have examples of a fully digitalized facility. KPI is targeting to reach the level of Digitalisation 4.0. In future, after basic automated and digital solutions have been introduced, a remote Process Control Centre is considered to be built to control processes at IGCC from Atyrau.

KPI will be digitalised in two stages. The first stage is scheduled to end in quarter 4, 2021 (parallel with the start-up of IGCC). The second stage will start after the IGCC is commissioned.

The first stage (before commissioning of IGCC) will include introduction of the following elements and systems: instrumentation and controls (I&C), emergency shutdown system (ESD), distributed control system (DCS), repair scheduling system, laboratory Information Management System (LIMS), manufacturing execution system (MES), employee training process automation (PC-based training simulators), plant 3D model; SAP S4/HANA includes not only the basic modules (ERP), but also manufacture scheduling systems, integrations with manufacturing systems (MES, LIMS) and the repair scheduling system, and a single digital window (a business analytics tool).

The goal of SAP/HANA project is to implement the latest versions of corporate and production SAP modules at KPI. All business processes for the project are based on best international practices and international experience for petrochemical facilities, the target organisational chart of the plant is based on best practices and benchmarking.

In addition to integration with the internal plant systems (MES, LIMS, IBM Maximo, EDCS), it is also integrates with external systems: electronic VAT invoices, client bank, zakup.sk.kz procurement system.

SAP core modules have been started since 01 January 2021: FI, TR, CO, MM, SD, HCM. Accounting, Procurement and Supplies, controlling and HR Management business operations are already implemented in SAP.

The second stage of KPI digitalisation includes introduction of an equipment reliability management system (AWS system), advanced automation with the advanced process control system, development based on SAP S4/HANA modules.

Digital technologies and solutions will increase efficiency of IGCC business: minimise equipment downtimes and production failures, reduce rejection rates, increase productivity of work, cut operational expenses (current repairs, raw materials, products, chemicals, utilities), increase income through better product yields as a result of the optimisation.